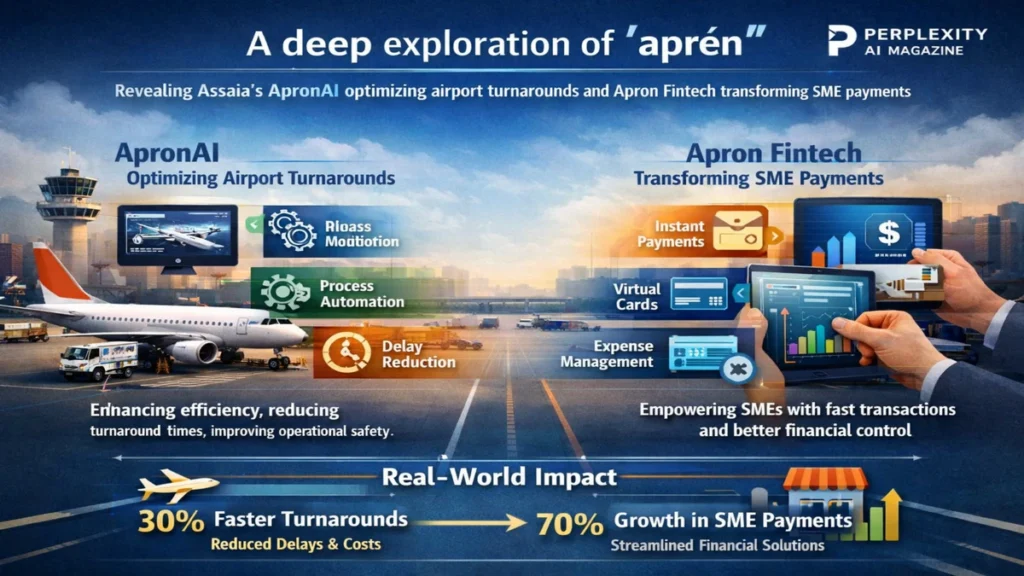

I first noticed the term “aprén” because it kept appearing in niche searches without a clear definition, and that ambiguity led me to two very different technologies sharing the same phonetic space. One is Assaia’s ApronAI, an artificial intelligence system used by airports to monitor and predict aircraft turnarounds in real time. The other is Apron, a fintech platform helping small businesses automate invoices, payments, payroll, and expenses. What interested me was not just that these tools exist, but that a single keyword could point to both operational intelligence in aviation and financial automation in business, revealing how modern software reshapes complexity across entirely different industries.

ApronAI by Assaia applies computer vision and machine learning to real-time camera feeds at airports, turning ordinary video into structured operational intelligence. It timestamps every step of an aircraft turnaround, predicts delays before they happen, and enables airports, airlines, and ground handlers to coordinate more effectively. Its purpose is to reduce delays, improve on-time performance, and create a shared operational truth across complex aviation environments.

Apron fintech addresses a very different operational challenge. It automates the administrative burden of managing invoices, supplier payments, payroll, and expenses. By digitizing documents through OCR, batching payments, and integrating with accounting platforms, Apron replaces fragmented manual processes with a single, automated financial workflow.

Although the two platforms are unrelated in function, they represent the same broader transformation: the use of software and automation to remove friction from complex systems. This article explains both platforms in detail, compares their architectures and impacts, and clarifies why “aprén” has become a meaningful but ambiguous search term across aviation and fintech.

Assaia and the Evolution of Airport Operations

Assaia is a Zurich-based aviation technology company founded to solve a persistent problem in airport operations: the lack of real-time, objective visibility into what is happening on the apron. Traditional airport operations depend heavily on manual reporting, radio communication, and siloed systems, which makes it difficult to predict delays and optimize resources.

ApronAI changes this by turning cameras into sensors. It uses computer vision to detect events such as aircraft arrival, chocking, baggage loading, fueling, boarding, and pushback. Each event is timestamped automatically, creating a precise digital record of the turnaround process. This data is then used to predict off-block times, identify bottlenecks, and alert stakeholders before delays propagate through the network.

The result is a shared operational picture that aligns airlines, ground handlers, airport operators, and air traffic management around the same data. Instead of reacting to delays after they occur, teams can intervene earlier, reassign resources, or adjust schedules proactively.

This shift from reactive to predictive operations is central to modern aviation efficiency. As traffic volumes increase and sustainability pressures grow, airports must extract more performance from existing infrastructure rather than expanding endlessly. ApronAI represents a software-driven way to do that.

Read: academic integrity ai news: Universities Redesign Trust and Assessment

Apron Fintech and the Automation of Business Payments

Apron is a London-based fintech company founded in 2021 to modernize how businesses manage outgoing payments and financial administration. Many small and medium enterprises still rely on email, spreadsheets, and multiple banking portals to manage invoices, payroll, and expenses, leading to inefficiencies, errors, and cash flow blind spots.

Apron consolidates these processes into a single platform. Businesses upload invoices and receipts via mobile, email, or integrations. The system uses OCR to extract relevant data, prepares payments in batches, routes them through approval workflows, and synchronizes transactions with accounting software like Xero and QuickBooks.

This reduces administrative overhead, shortens payment cycles, and gives businesses real-time visibility into their cash position. Instead of finance being a monthly or weekly chore, it becomes a continuous, automated process.

The platform’s expansion into expense cards and payment collection further embeds financial operations into daily workflows, reducing friction between accounting, operations, and management.

Comparison Table

| Dimension | ApronAI by Assaia | Apron Fintech |

|---|---|---|

| Industry | Aviation | Financial technology |

| Core Technology | Computer vision, machine learning | OCR, workflow automation |

| Primary Users | Airports, airlines, ground handlers | SMEs, accountants, finance teams |

| Main Purpose | Optimize aircraft turnarounds | Automate payments and expenses |

| Data Type | Operational event data | Financial transaction data |

| Impact Area | On-time performance, efficiency | Cash flow, admin efficiency |

How Both Platforms Reduce Operational Friction

Despite operating in different domains, both ApronAI and Apron fintech solve structurally similar problems. They replace manual, fragmented processes with automated, integrated systems that create shared visibility.

In airports, ApronAI replaces radio calls and manual logs with objective data. In finance, Apron replaces spreadsheets and emails with automated workflows. In both cases, the human role shifts from data collection to decision-making.

This reflects a broader trend in enterprise software: the transition from systems of record to systems of action. Data is no longer collected only for reporting but for immediate operational improvement.

Feature Comparison Table

| Feature | ApronAI | Apron |

|---|---|---|

| Real-time event tracking | Yes | No |

| Predictive alerts | Yes | No |

| OCR document capture | No | Yes |

| Payroll automation | No | Yes |

| Workflow approvals | Operational | Financial |

| Integration focus | Airport systems | Accounting systems |

Takeaways

- “Aprén” is not a standalone entity but a phonetic pointer to ApronAI and Apron fintech.

- ApronAI transforms airport operations through real-time visibility and predictive intelligence.

- Apron fintech automates financial workflows for small and medium businesses.

- Both platforms remove friction from complex operational systems.

- Each reflects how automation shifts humans from manual work to strategic oversight.

Conclusion

The ambiguity of the term “aprén” mirrors a deeper reality of the digital economy: innovation is increasingly domain-specific, yet structurally similar. Assaia’s ApronAI and Apron fintech operate in different worlds, but both use software to bring clarity, efficiency, and predictability to environments historically defined by complexity and fragmentation.

ApronAI makes the invisible visible in airport operations. Apron makes the tedious effortless in business finance. Together, they illustrate how modern platforms are not simply digitizing existing processes but redesigning them around automation, data, and integration.

Understanding “aprén” is therefore not about identifying a single company, but about recognizing a pattern of technological evolution across industries.

FAQs

What does “aprén” mean

It is not an official brand but a phonetic variant pointing to ApronAI and Apron.

Is ApronAI related to Apron fintech

No, they are separate companies in different industries.

Who uses ApronAI

Airports, airlines, and ground handling operators.

Who uses Apron fintech

Small businesses, accountants, and finance teams.

Why does the term appear in searches

Because of phonetic similarity and niche professional interest.